Vertica Partners is a vertically integrated full-service real estate advisory and investment firm focusing on institutional grade residential aggregation, land and development services and multifamily investment sales.

Vertica Partners provides two distinct brokerage platforms for investors. Vertica Commercial Advisors focuses primarily on Build-For-Rent (BFR), development projects, multifamily investment sales and buyer representation acquisition assignments while Vertica Realty, concentrates exclusively on institutional grade residential aggregation.

The Vertica family of companies provide a full range of tightly integrated services including advisory, investment sales, development, title, asset management, valuations and select equity investments.

OUR EXPERIENCE

Recent and relevant transaction history is critical to demonstrate the success of any real estate organization. Over the last 10 years, we have transacted more than $1 Billion in sales volume representing more than 10,000 units throughout the Southeastern United States.

Vertica’s client roster include top developers, builders and financial institutions such as Angelo Gordon, Beazer Homes, Camden Property Trust, Crescent Real Estate, C-III Capital Partners, David Weekley Homes, DDR, Madison Capital, Nuveen, Principal Financial, Scripps Media, Strategic Property Partners and Varde Partners among others

APARTMENTS

BULK CONDO & SFR

LAND

INVESTMENT SALES

MULTIFAMILY

Vertica has sold thousands of multifamily units throughout Florida since 2010 including market rate, single-family rental, fractured condominiums, senior housing, manufactured homes and affordable communities.

Vertica actively invests our own capital in various real estate investment ventures and development projects and we source, underwrite, own, operate and actively manage our own portfolio. We also selectively co-invest with various clients as our market knowledge, expertise and ability to execute provides tremendous value to the team and project.

We firmly believe real estate is the greatest creator of wealth and multifamily affords the best opportunity, and upside, of all real estate asset classes.

FRACTURED CONDOS

With nearly $200,000,000 in fractured condominium sales since 2010, Vertica Commerical Advisors is one of the top specialist nationally in this unique product niche. Whether you are looking to buy or sell, we are your complete multifamily solution provider.

In addition to the extensive experience in dealing with bulk transactions, Vertica Realty is also one of the only residential advisory firms with a commercial based investment background to assist institutional owners in acquiring additional one-off units through our comprehensive Condo Repurchase Program.

This program provides an opportunity for the owner to gain further economies of scale, while adding to their existing inventory through direct marketing efforts, foreclosure auctions, short sales, tax deed foreclosures and MLS based transactions. Vertica Realty has worked in dozens of communities throughout Florida with the top investment groups and private equity firms.

Vertica Realty works exclusively with institutional investors and not individual investors or home owners.

Bulk Acquisitions/Dispositions

Individual Unit Acquisitions

Conversions/Reversions

Association Advisory Services

Structured Sales Programs

BULK CASE STUDY

BUYBACK CASE STUDY

FULL SERVICE CASE STUDY

DEVELOPER AND LAND SERVICES

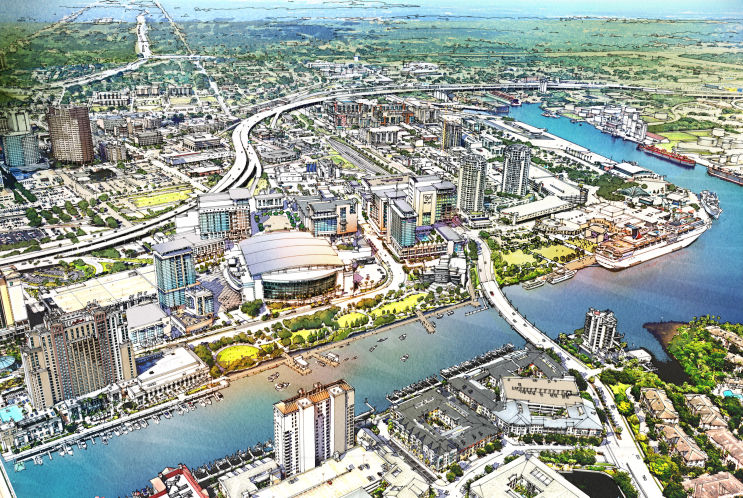

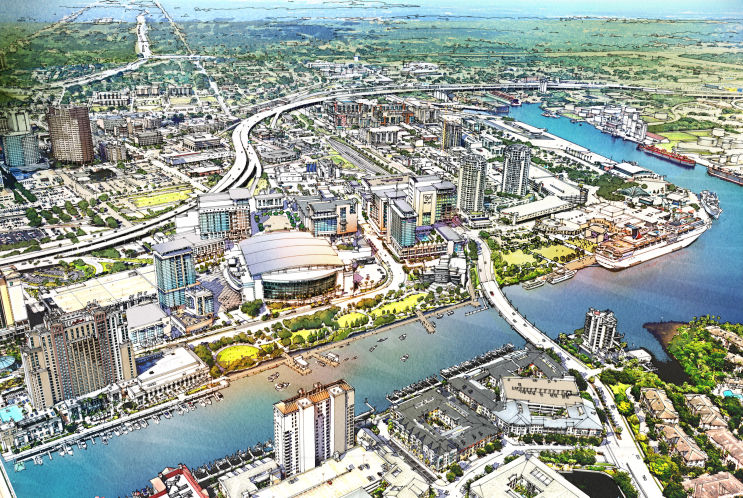

Vertica has advised and transacted land on new development projects worth more than $5 billion throughout the southeastern United States. Projects range from exclusive representation on land assemblage for the multi-billion dollar mixed-use Water Street Tampa project currently under development (a joint venture between Tampa Bay Lighting owner Jeff Vinik’s Strategic Property Partners and Cascade Investment, LLC, the investment fund of Bill Gates,) to more than 10,000 multifamily and single family lots for new development.

Vertica has joint ventured on nearly $100 million in new development projects including several new construction Build-For-Rent (BFR) communities in multiple markets.

RESIDENTIAL AGGREGATION

Vertica is a national leader in the aggregation of residential properties. Since 2010, Vertica has transacted more than 10,000 institutional grade residential units in Florida representing more than $1 billion in transaction volume in a combination of one-off and bulk transactions.

Vertica has previously functioned as the Florida Operating Partner for a private SFR REIT deploying more than $125 million in capital and provided advisory services on the enterprise sale of the platform for more than $265 million. Vertica has handled dozens of exclusive acquisition, advisory and valuation assignments for various institutional partners across the state in every major MSA.

The Vertica aggregation platform is best-in-class, highly scalable and serves all residential product types across Florida. Acquisition channels include direct marketing, foreclosure auctions, short sales, tax deed foreclosures, note sales and MLS based transactions.

BULK SFR

STRUCTURED ACQUISITIONS/DISPOSITIONS

FRACTURED CONDOS