by admin | Jan 5, 2016 | Market Data

Investments in several condo and apartment developments, plus new shops, offices and a planned medical school, make the Channel District in downtown Tampa the hottest real estate market in the Tampa Bay region.

Source: www.83degreesmedia.com

The Channle District in downtown Tampa is one of the hottest submarkets in the Southeastern United States. Currently, about 3,300 people now live in the district, and that number will grow to about 5,000 when projects currently under construction or seeking residents are completed and full.

With the addition of Jeff Vinik’s Strategic Property Partners project, there is nearly $3 billion in projects under development.

Vertica Partners principals, T. Sean Lance and Max Boehmer have sold the land for the majority of the projects in the area including exclusively representing Vinik’s group on their land acquisitions in addition to the land for PierHouse Apartments, Florida Crystal’s Channelside Apartments and Phase II for The Place at Channelside Condominiums to name a few.

by admin | Dec 30, 2015 | Market Data

For commercial real estate investors, the good times may be over.

Source: www.nationalmortgagenews.com

With a deceleration of asset appreciation coupled with a rise in interest rates…is now the time to sell? The answer is not always so simple and in this case “it depends”.

Early entry value-add investors that purchased in the last 3-5 years would probably fall into the camp of sellers. They experienced a great increase in rents, occupancy and values and the question remains of how much meat is left on the bone for them.

Meanwhile, other groups are taking a more long-term view of the marketplace and are looking to deploy capital on the basis that the United States is in a good position for the economy to steadily improve for the foreseeable future.

The decision to buy or sell is up to each individual investor, but it seems 2016 will be a crossroads where these two groups transact.

by admin | Dec 30, 2015 | Market Data

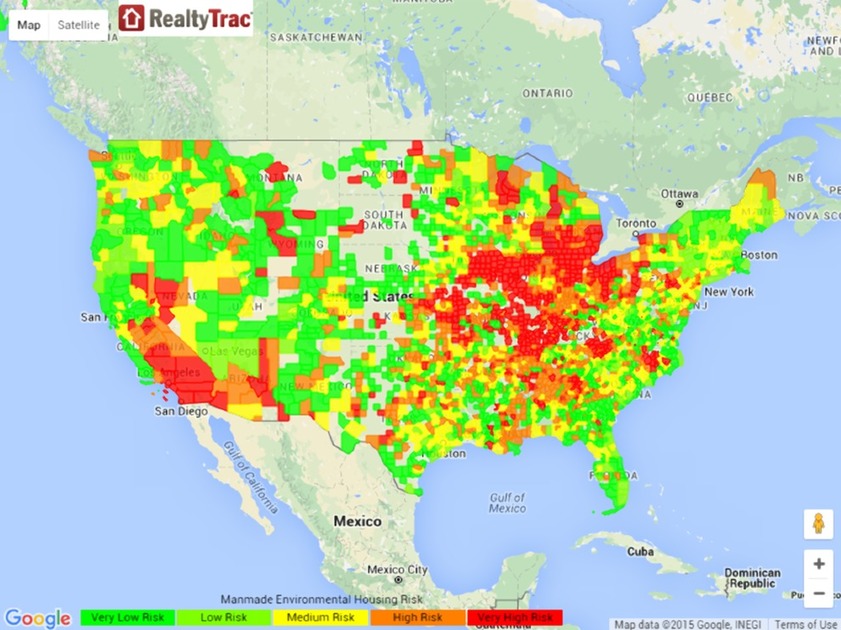

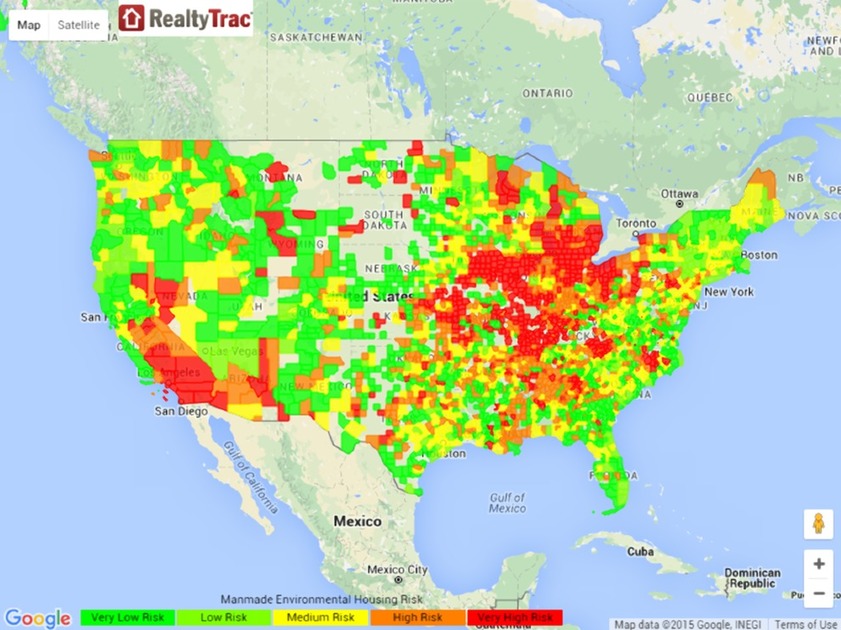

Over 25 million U.S. homes are in zip codes at high risk or very high risk for manmade environmental hazards.

Source: www.worldpropertyjournal.com

Florida included 4 of the 12 major metro areas with no zip codes at high risk for man made environmental hazards including Cape Coral-Fort Myers, Naples, Palm Bay & Port St. Lucie.

by admin | Dec 30, 2015 | Market Data

(Special) – The low Canadian dollar and higher real estate prices in the United States don’t seem to… – Personal Finance – Winnipeg Free Press.

Source: www.winnipegfreepress.com

Canadians remain Florida’s number one international purchasers of real estate, accounting for more than 30 per cent of all foreign home sales in 2013.

“Canadians purchase approximately six per cent of all homes sold in Florida,” the report says. “Loyal snowbirds and other Canadians who own property in the state inject nearly half a billion dollars annual into the economy through property taxes.”

by admin | Dec 30, 2015 | Market Data

The main reason for the increase in foreclosure risk while the homeownership rate remains little changed is leverage, according to economist Sam Khater.

Source: www.dsnews.com

The relationship of leverage to residential foreclosures revealed four main findings:

1) Foreclosure risk is two to three times higher than it was 50 years ago despite homeownership rates being close to their 1960s levels;

2) leverage has been a primary driver of foreclosures during the last 50 years, and that the strong role of leverage has rendered savings and income changes insignificant drivers of default;

3) high inflation rates in the 1970s and 1980s propelled nominal home prices, resulting in reduced aggregate LTV and lowering default risk – thus stabilizing foreclosures during those decades; and

4) government regulations aimed at making the mortgage market safer for consumers center on an income-based ATR rule that manage the risk of delinquency, but are not so much focused on foreclosure risk.

“Therefore, leverage as the most important driver of foreclosure performance over the last five decades remains unaddressed for the market,” Khater wrote. “In the future, policy makers may need to consider exploring their ability to manage the leverage cycle to promote residential financial stability.”