by admin | Dec 29, 2015 | Market Data

FloridaTrend.com delivers Florida business news along with reports on Florida politics, Florida public policy and government. Florida executives and professionals rely on FloridaTrend.com for in-depth analysis and perspectives on the issues, people and ideas that define Florida.

Source: www.floridatrend.com

Since 2011 Florida’s job market has added nearly 975,000 non-farm jobs. There has also been a consistent and positive trend for job growth over that time span. In the past year alone, Florida has added approximately 240,000 non-farm jobs, a sign that Florida’s economy is still on the rise going in to 2016.

by admin | Dec 29, 2015 | Market Data

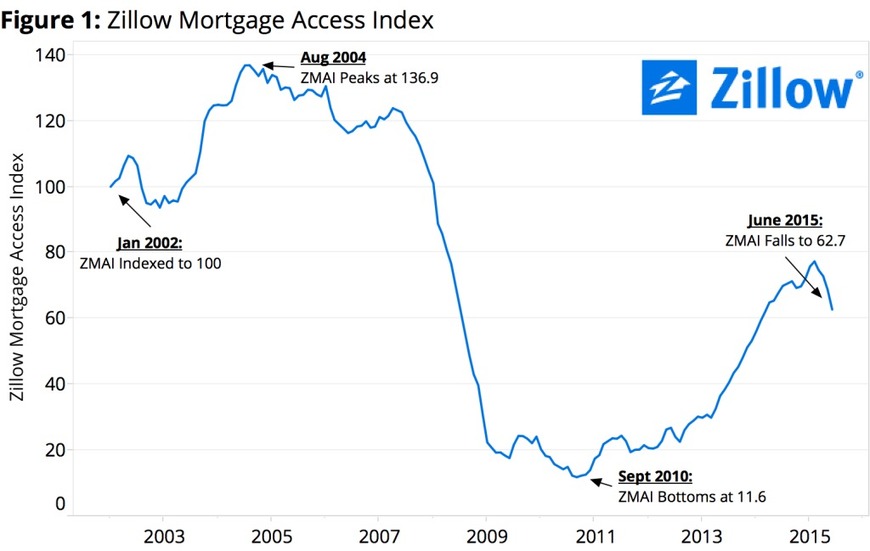

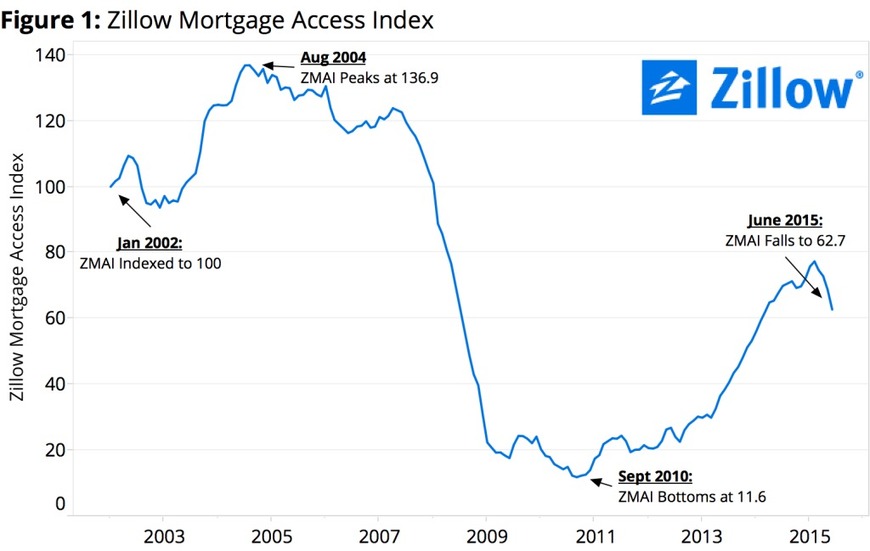

For the first time since 2012, getting a mortgage today is harder than it was a year ago.

Source: www.zillow.com

For the first time since 2012, getting a mortgage today is harder than it was a year ago, largely because lenders are raising the bar on what they think is a minimally acceptable credit score.

To avoid the housing bubble of recent memory, lenders have maintained higher credit standards as opposed to giving loans out to any that could “fog a mirror”.

While this approach my be painfully slow for some, it shows good restraint is a healthier long -term option for the housing market and economy as a whole.

by admin | Dec 29, 2015 | Market Data

A Tampa developer rumored to be working a deal with the specialty grocer has closed on more land.

Source: www.bizjournals.com

As land becomes more scarce, and more expensive, in highly desirable South Tampa, developers will have to be creative to find sites for new development.

by admin | Dec 26, 2015 | Market Data

Cape Coral has ended 2015 the same way it began, with accolades for economic growth.

Source: www.lehighacrescitizen.com

Cape Coral was ranked No. 9 as one of the top 10 Boomtowns according to SmartAsset. With no prominent industry to point to, Cape Coral is wedged between Sarasota-Bradenton to the north and Naples-Ft. Myers to the south. Both of these areas are experiencing tremendous growth and rising housing costs so a less expensive alternative with good life style factors is likely the reasonable explanation for recent good fortunes.

by admin | Dec 26, 2015 | Market Data

Home prices are closing in on their records of the last decade, reigniting fears of bubbles. Time to panic? In most markets, probably not.

Source: blogs.wsj.com

Generally speaking the sentiment id the industry is that while there may be a few housing markets that are over-valued, there seems to be very little concern that we are in bubble territory.

San Franciso, New York and Denver are three markets nationally that are widely considered the most overvalued.

Some epicenters of the housing bust such as Phoenix, Las Vegas and Tampa look like they have largely returned to their long-run averages. While this means we don’t have to worry about bubbles in these places, it does mean that homeowners who bought or took cash out of their homes during the bubble still owe more than their homes may be worth.